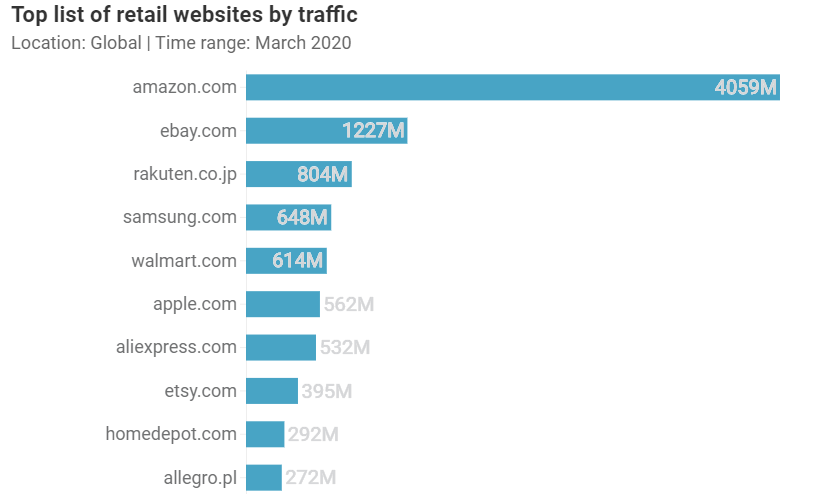

The year 2020 has been defined by the looming spectre of COVID-19. As government norms order non-essential retailers to close, and social distancing thins out the streets, consumers are increasingly looking towards e-commerce and online shopping to fulfil their needs. According to a research conducted by Ipsos, consumers in 11 out of the 12 markets surveyed were more frequently purchasing traditionally in-store goods online. Over 57% of Vietnamese customers have shifted their purchasing online. India (55%) and China (50%) also show comparable numbers.

Retailers are adapting

As consumers begin to settle into their new purchasing habits, it becomes increasingly important for retailers to develop and strengthen their online presence. This may be realised not only through e-commerce, but also through digital advertising. Many retailers are also beginning to introduce curbside pickups in an effort to promote Omnichannel service.

Firms Best Buy, The Michaels Companies, and Joann.com introduced the pickup service in late March, while massive retailers like Walmart and Target bought in services to promote the ease of their curbside options, mainly through their mobile apps. App Annie claims that downloads of the Walmart app increased by over 450% in late March.

Besides shifting to e-commerce and promoting contactless delivery, retailers are prioritising shipment of essential products over the rest, and adding perks like free shipping and ecommerce discounts to entice customers.

Shift in demand

With the changing landscape and customer outlook, the demand for different goods online have also shifted. Fewer customers are looking to buy products like camera equipment, luggage, swimwear and store fixtures, but the sales in categories like food and beverages, books, toys and games, beauty products, and garden equipment have shot up.

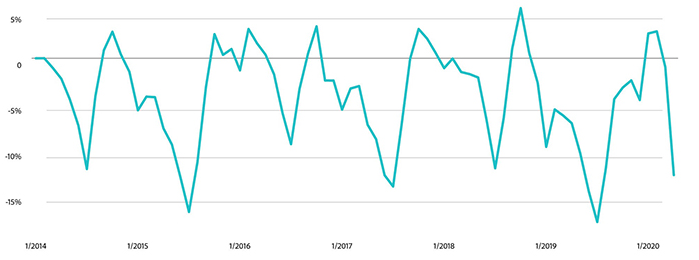

The prices for apparel online dropped by 12% in the US, setting a record for the highest April drop in five years. UK’s Net-A-Porter recently introduced discounts on 30% of its range, while Joules UK offered an extra 10%-20% off on their products as compared to 2019.

Many online retailers have benefitted from adapting their businesses to better suit current circumstances. According to CNBC TV18, the gross merchandising value (GMV) of E-tailing platforms witnessed a 15-20% increase within the first fortnight in March compared to February 2020. Multi-channel retailers in the UK saw their sales increase by over 35%, which is more than 3 times higher than their online-only counterparts.

Some new problems

But with the growth of online sales comes another host of problems, like labor scarcity, order delivery delays, and other technical and logistical issues. Another problem occurs when off-price retailers grow to a level where they start eating at the sales of other retailers. Referred to in McKinsey and the Business of Fashion’s joint report as the ‘contagion of deep discounting’, this problem is predicted to affect middle-market designers and retailers worse than others.

However, despite setbacks, the challenge of remodelling their supply chains and keeping up with unexpected stock and demand fluctuations has its share of long-term benefits for retailers and brands. These tweaks could help build robust and flexible operations systems which are better fit to weather other unprecedented economic crises in the future.

Interested in retail or pricing? Drop your email here and we’ll get back to you!