The emergence of Singles’ day as the world’s biggest shopping bonanza.

You have definitely noticed all the buzz surrounding the festive shopping season. Yes, I’m talking about the ‘Black Fridays’ and the ‘Cyber Mondays’. And if you work in in retail or e-commerce, what excites you more than the deals is the performance of the deals!

Over the last decade, there has been a steady growth in the total amount spent on shopping, as well as the amount spent per shopper — the exception to this being 2008 (no surprises here, owing to the Great Recession).

“The average annual increase in total money spent (in the US) is 2.5 percent, which takes into account a steep 4.6 percent decline in 2008. Before the 2008 financial crisis, the 10-year average annual increase was 3.5 percent.”

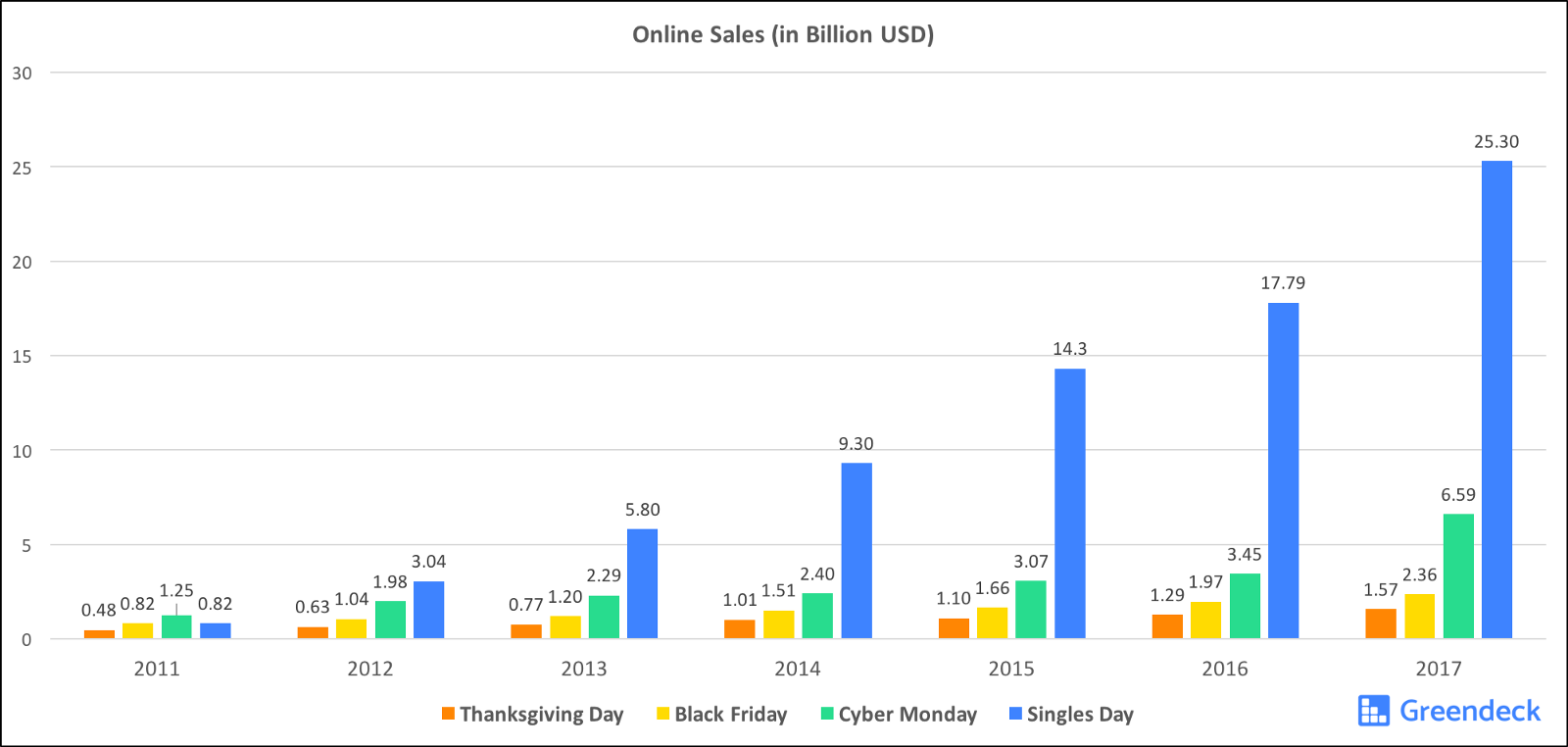

But these numbers fall flat when compared to the staggering growth of Singles’ day sales, and the mammoth scale they have achieved now.

From humble beginnings…

Singles’ Day began as an anti-Valentine’s Day movement in the 1990s when students at Nanjing University started celebrating their singledom.

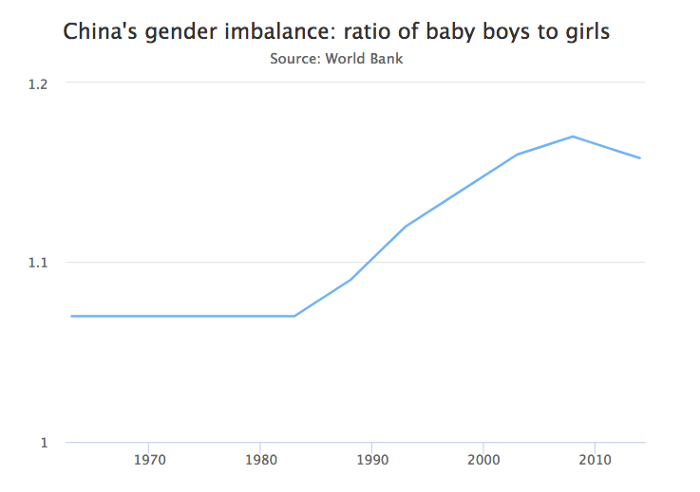

But why is ‘singledom’ a big thing in China?

In 2011, official Chinese data showed that there were 20 million more men than women under the age of 30. By 2020, sociologists expect that discrepancy to have widened to 35m.(source)

“By 2030, it is estimated that one-in-four Chinese men in their late 30s will never have married"

But what began as a simple marketing event for internet shopping in 2009 — when a mere 27 merchants offered discounts on the Alibaba-owned Tmall.com website and consumers spent just around $7.5M— has turned into arguably the most important shopping phenomenon globally.

To staggering growth…

The total amount spent on shopping in the US during Thanksgiving, Black Friday, Cyber Monday and Amazon Prime day (all combined!) in 2016 was $9.2B. The same year, on Singles’ day alone, this value was $17.8B.

And if you thought this figure was hard to beat, this year’s Singles’ day roped in $25.3B in sales!

In fact, Alibaba surpassed last year’s final purchase figure of $17.8 billion at 1:09 PM local time, just 13 hours after the festival began. (source)

A change in landscape

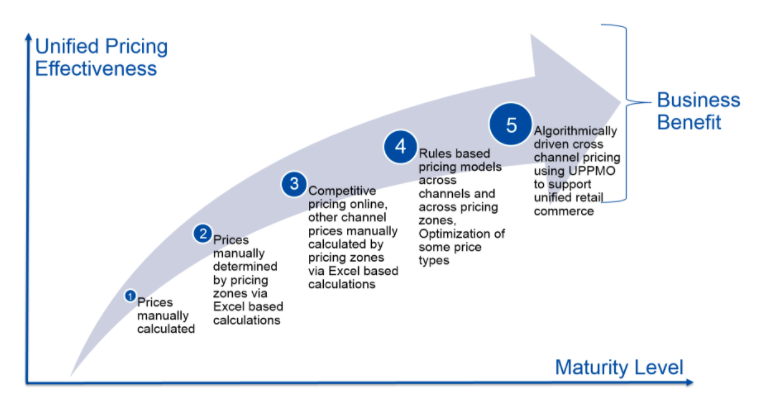

Growth in online shopping has opened up a new world for retailers — dynamic pricing.

The U.S. retail ecosystem revealed that it takes Amazon two minutes to make a price change, compared with 30 days for a U.S. e-commerce site. And the U.S. offline market averages a staggering 270 days to make the change — so there’s little wonder why some brands are losing out on sales.

The influx of pricing changes flooding the $1.9 trillion global e-commerce market has forced merchants and brands to rethink their pricing strategies on the fly, and swiftly up their game to compete.

In fact, Gartner has found that most large retailers are struggling to reach the fourth stage (see picture above). The result is failure to achieve the significant business benefits derived from more complete adoption.

What to expect

It’s exciting to see what new heights are scaled by Singles’ day in the coming years. Also, how many years before we need a magnifying glass to see the sales on a graph alongside Singles’ day!

Change drives innovation. Evolution in shopping (from offline to online) has driven tons of innovation in fields like marketing, pricing, logistics, merchandising etc. And if retailers and brands want to stay relevant, they have to buckle up and ride on these changes.