Gap, Victoria’s Secret, J.C. Penney, Abercrombie & Fitch, House of Fraser, Foot Locker. The list of retailers who have shut down stores in the past 2 years is almost endless.

There's a long list somewhere out there titled - "But they're such a big brand, how could this happen? Tough time for retail, I guess 😅". And this list seems to be growing quite rapidly!

The latest entry is that of Forever 21. They are reportedly preparing for a potential bankruptcy filing, after talks for additional financing and debt restructuring have stalled. The fashion retailer currently operates more than 800 stores across the US, Europe, Asia and Latin America.

A lot of macro economical factors may have led to a general decline in demand. There isn't much that retailers can do about this. But there are many things still in their control, such as creating a product catalogue that resonates well with their shoppers.

Successful Assortment Planning

Merchandise or Assortment planning typically involves a review of historical company data, fashion forecasts, competitor catalogues and the retailer’s goals for future seasons.

You need to strike a balance between (1) Which categories to buy (2) Which SKUs within each category and (3) How many units to stock (inventory).

Successful assortment planning provides the right products at the right price and time and does not lead to losses in current or potential sales. In fact, studies have shown that success of assortment planning for retail buying has a major and direct impact on firm performance (e.g., overall profitability, customer service).

Picking up the right signals

In the US, 'Athleisure' is a top growing category, worth $46B in 2016. For years, athletic products for women were simply designs for men in smaller sizes and more feminine colours. For many companies, women haven’t been the main focus — or even taken into account at all — when products, retail experience and marketing messages were being created.

But now the 'shrink it and pink it' strategy doesn't work. A Nielsen report revealed that American women alone wield $5 trillion to $15 trillion in purchasing power annually.

"Now [the female consumer] knows that brands can, in fact, make women-specific products and she’s demanding that they do so" says Matt Powell, sports industry analyst at the NPD Group.

Puma - Fenty Partnership

Puma had an ambition of reaching out to a wider female audience. Their collaboration with Rihanna's 'Fenty' was the turning point for them.

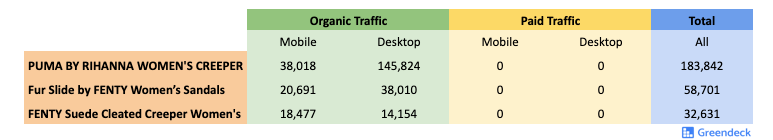

In fact, the top 3 most searched products on the Puma US website were all from Fenty. What's more - 100% traffic was organic!

This collaboration led to a massive boost in overall sales. The Rihanna partnership helped net earnings for Puma to leap to $68m from $43m a year ago. Overall, sales rose 13% to $1.22bn (source).

Athletic brands have always established partnerships with athletes. Ronaldo with Nike, Messi with adidas. It’s an easy way to transport the “quality” of these players to the products. But establishing a partnership with Rihanna, who isn’t even an athlete, is an example of how companies who have built a traditional image and struggle to differentiate and reach new markets, can somehow have a different positioning in the market and connect with their audiences.

In this case, it was directed for women and women value Rihanna, and that’s why Puma’s campaign was so successful.

Interested in retail or pricing? Drop your email here and we’ll get back to you!