Dynamic pricing has been an invaluable strategy for scores of retail companies looking to set prices based on demand and ultimately drive sales and build profits. This is done by tracking trends and analysing data patterns using machine learning algorithms in order to get the optimum price. McKinsey statistics indicate that dynamic pricing strategies, if properly refined, can result in a sales growth of 2-5% and a margin growth of 5-10%. They have also reported higher levels of customer satisfaction because of the improved insights on price sensitive items.

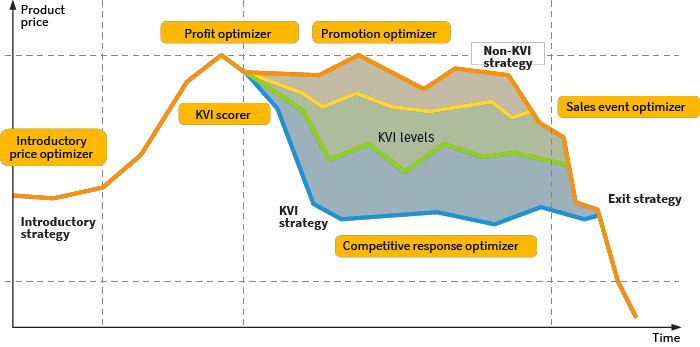

The product life cycle begins with its introduction into the market. New products are priced with different considerations in mind. Strategies include skimming (pricing high to skim off market share and profit) and penetration (pricing low to quickly penetrate the market). Hence, Artificial Intelligence can use pricing history of similar products and markets to set introductory prices.

Once the glamour of a new product fades, companies must determine its elasticity in the market. Elasticity refers to the effect that a change in price brings about in consumer demand. An inelastic product retains its demand, and can be aggressively priced to increase margins. AI models use big data analytics and time series algorithms to determine elasticity.

At this point it has to be ensured that the product's price is in a similar range to comparable products sold by other retailers. Price is a direct representation of 'value', and consumers will not be willing to pay extra if they don't perceive additional value as compared to other options.

Intermediate pricing strategy is influenced and shaped by opposing factors: internal economics of the company and consumer price perception. A classic module that addresses this problem is the Key Value Item (KVI) strategy. Goods that influence the ‘value perception’ of the company are defined as KVI’s and these goods determine the company’s public image as ‘expensive’ or ‘cheap’. Goods are then priced off the following considerations:

● Given the influence that a KVI can have on public perception, they are often priced accounting for consumer demand and alternatives. This means that economic concerns are ignored.

● Non-KVI products must now account for these concerns, and are priced with certain margins in mind. This assures that companies make a profit while keeping consumer satisfaction

Companies use predictive pricing platforms determine, update and price of their KVI’s based on transaction-and-basket data, consumer perception and surveys, and merchant judgement.

Modules may also be built based purely on market alternatives and competitor pricing. Online retailers like Amazon often utilise real-time AI solutions to dynamically price their products to match and undercut their rivals. BusinessInsider claimed that the average product on Amazon had its price changed every ten minutes.

Finally, companies must deal with synchronisation between offline and online channels, to normalise prices and deal with coordination issues.

A well-developed dynamic pricing system should incorporate all the modules mentioned above, but retailers often start off with one or two in the interest of responsiveness, and add the rest over time. Retail companies are increasingly looking to invest in dynamic pricing to secure their place in the market. It will be a very exciting space to watch!

Interested in retail or pricing? Drop your email here and we’ll get back to you!